It is no secret that everyone desires financial freedom. However, very few actually take action towards creating the life they want. Very few people take the necessary action that will allow themselves to realize financial freedom.

Many people are stuck with the fantasy of making money while you sleep, looking for opportunities such as a quick and easy way to make a million. This works for some people and it allows for the word “LUCKY” to be thrown into the sentence as a convenient vocabulary. Here is the thing about luck it runs out at some point, in our opinion.

What doesn’t run out? Effort doesn’t, it changes in degrees either going up or down but it never runs out unless you quite.

So how do you build the best financial portfolio that will allow you to maintain wealth?

Let’s introduce you to Harry.

Harry is a college graduated and doesn’t have any debt yet. He was fortunate enough to have had some savings to help pay for tuition and a modest registered education savings program that was initiated by his mother when he turned twelve.

Harry is excited to finally start living the life everyone told him he would live once he went to school and got himself a job.

A job is a next thing on the list of things to check off, so that is what he does, he goes and finds himself a job so he can start making tons of money and live lavishly.

The hunt for a job didn’t take long because Harry is a charismatic individual that knows how to land the role. Harry managed to secure himself a position as a third party collections officer working on behalf of the government. This role offered a very decent compensation package and retirement savings plan, all which Harry knew very little about so didn’t really pay much attention to. You see, Harry grew up in a home with very little financial education. The family had only one idea when it came to money and it was work, save, and spend the money you earn. There was no financial literacy and it didn’t look like it would be introduced to the family in time to save them from what was about to happen to Harry.

Within eighteen months of working as a collections officer, Harry was able to make a purchase that was very significant. He finally made one of his childhood dreams come true. He bought his very own condominium apartment. Not very much savings had to be used as it was his very first home and he was eligible for the first time home buyers program that allowed first time home buyers to put far less of a downpayment than was required. This was great for Harry because he didn’t have much saved for a down payment, but, his income was high enough for the lenders to give him the mortgage. They must have had a crystal ball that looked into the future and saw Harry’s financial future, or, it could have possibly been the fact that Harry was being given lines of credit at the amounts of $5,000 and $12,000 and not to mention credit cards with limits as high as $15,000. Did Harry have an amazing credit score? Absolutely. Was it going to stay that way? Not a chance.

The one thing that made him “look” successful, even if his bank account balance was in the negative.

The series of events that happened next were almost predictable. Harry and his girlfriend split which leads him down a spiraling road of failure. To make up for the feeling of disappointment Harry decided that he needed to purchase a used Volkswagon Jetta for $6500, the exact amount on one of his credit cards causing him to max it out.

With new payments to the credit card, car insurance, mortgage and miscellaneous expenses, Harry quickly finds out that he is not earning enough to cover the expenses and still have money left over to save. At least this is what he thought, so this is what he believed and this is what lead Harry to use the other lines of credit to pay for his mortgage, food and miscellaneous expenses. Taking from Peter to pay Paul essentially.

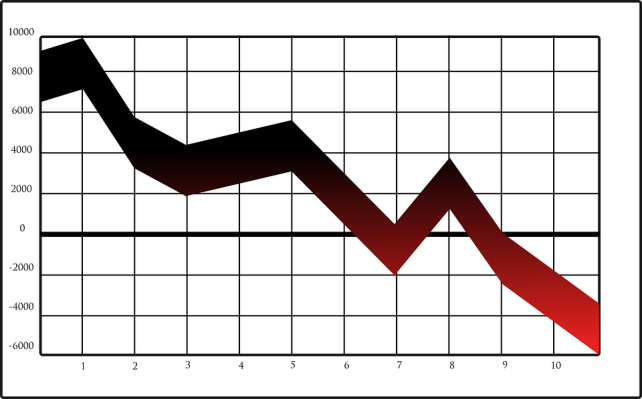

Within eight months Harry found the balance of his $12,000 line of credit at zero. His second line of credit of $5,000 was left with $5.00. His credit card with $15,000 balance was at $400.00 and his $3,000 credit card was at the balance of $500.00. How did this happen? Harry wondered. How did all the money run out? He was still working full-time but the money just wasn’t enough to pay off all the debt that he had accumulated. Where was this lavish life that everyone promised him would happen once he went to school, graduated, and got a job?

The panic was high, because Harry didn’t want to lose his apartment. That was the one thing he had left. The one thing that made him “look” successful, even if his bank account balance was in the negative.

Harry needed help and he needed it fast. Naturally, his thoughts led him to this common conclusion, if there is not enough income from the first job then get a second one to make more. And that is exactly what Harry did. Harry found a part-time job at a restaurant to make extra income to pay back his debts. He initially applied to be a server, as servers have the benefits of earning tips which would be a bonus for Harry. But Harry was offered a job in the kitchen as a line chef. His desperation didn’t allow him to challenge the offer, he accepted without a moment’s hesitation.

Harry was on a mission to eradicate his debts and keep the second job long enough to put some extra savings away in case of a rainy day thunderstorm similar to the one he was facing. Maybe even work towards building a financial portfolio of homes so he could begin to earn money that way. This would be the perfect portfolio.

After ten months of working two jobs and not making any advancements on his debts, Harry realized that he was in need of professional help. He tried to speak with financial planners at the banks to help him find the best solution to his problem. No financial institute could consolidate his loans into the mortgage or design a plan that would avoid filing for Bankruptcy. How can he build a perfect portfolio if no one will help him consolidate his debts?

After three months of inquiring with financial experts, several letters from the financial institutions where the credit cards and line of credit lenders came from, and a few soft collections calls, Harry was finally ready to give up the battle and file for consumer proposal. It just seemed like that was his only option left.

What advice could have been helpful to Harry?

In the book, The 4 Laws Of Financial Prosperity we learn about:

- Tracking

- targeting

- trimming

- training.

The ideas in this book are very simple. That is why we believe they get forgotten quickly if we are not developing a habit around them. Developing a habit requires that you do something regularly enough for it to become consistent, once you make it consistent you unconsciously turn it into a habit, an automatic response to an activity or stimuli.

The First Law Is TRACKING

Taking the time to assess all of your income and all of your expense each month will allow you to understand exactly where each person is going with their finances. The idea may sound like a daunting task, however, if you’re serious about achieving financial freedom it is wise to make the effort. Not only that but make it a habit to do it once a year. That way you build a habit to monitor you and your families spending and discover ways to eliminate the unnecessary expenses that incur.

The Second Law Is Targeting

Setting goals to achieve helps to create a stable system to get to your goal. Setting the important financial goals you have for yourself and your family gives you an opportunity for you to see and gauge your progress. Seeing your goals written down helps to manifest them every time you remind yourself by looking at them.

The Third Law Is Trimming

Trimming allows you to think of the future. When you put first things first you get into the headspace of paying yourself first. Whether it’s 5% 10% 15% or 20% the idea is to live below your means. Make automatic savings plan to deduct at least 10% of your income, then live on the rest and pay your debts down.

The Fourth Law Is Training.

Once you have learned the other three laws it’s time to keep yourself sharp and up to date with information that will educate you on vehicles for investment. Your goal is to be ready to make an intelligent decision on great assets, not fancy liabilities.

There really isn’t the best portfolio only a portfolio that is best for you. And how you get to know what is best for you is to get an understanding of what you want and what you need to get you there.

Harry could have used the four laws of financial prosperity to really set himself up for financial success, and on the way to building that perfect portfolio.

Quote:

Anyone can earn money but it takes a wise man to keep it.

Thanks for reading. If you enjoyed what you read and found it useful then don’t forget to share it.

Laws Of Financial Prosperity

After looking at a handful of the blog articles on your blog, I truly like your technique of writing a blog. I book marked it to my bookmark site list and will be checking back in the near future. Please check out my web site as well and let me know what you think.

Awesome, thanks Cleo.

very interesting info ! .

Glad you enjoyed it. Go forth and build the portfolio of your dreams.